- June 8, 2022

- Posted by: admin

- Category: News

Prepared by the KSE Institute team and KSE members of the Board of Directors; 30.05.2022-05.06.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua and squeezingputin.com websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

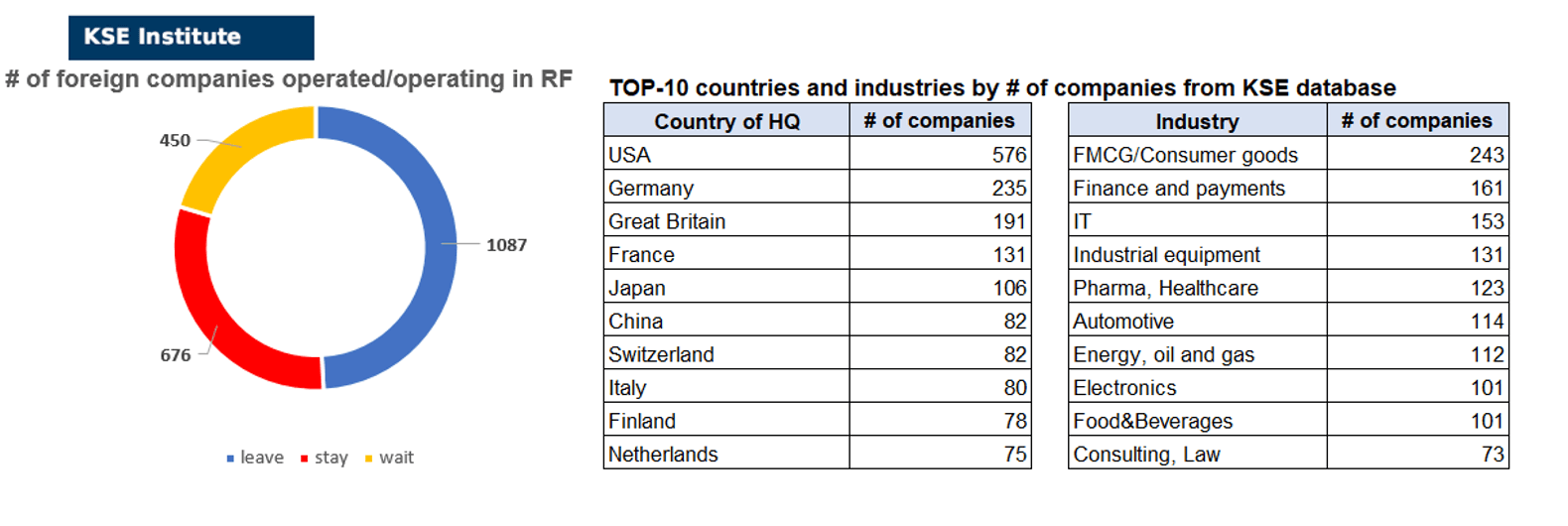

KSE DATABASE SNAPSHOT as of 05.06.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 676 (+86² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 450 (+12 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 087 (+50 per week)

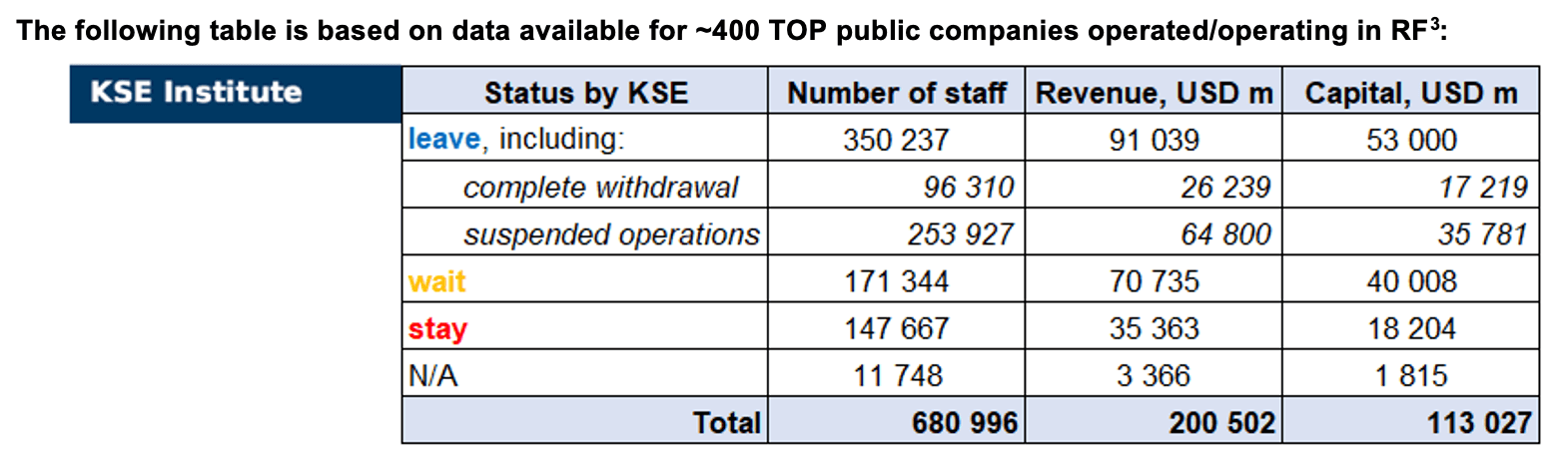

As of June 05, we have identified about 2,213 companies, organizations and their brands from 75 countries and 55 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $200 billion), as well as staff (almost 0.7 million people). 1,537 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of June 05, companies that declared a complete withdrawal from Russia had $26.2bn in revenues and $17.2bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $64.8bn and $35.8bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

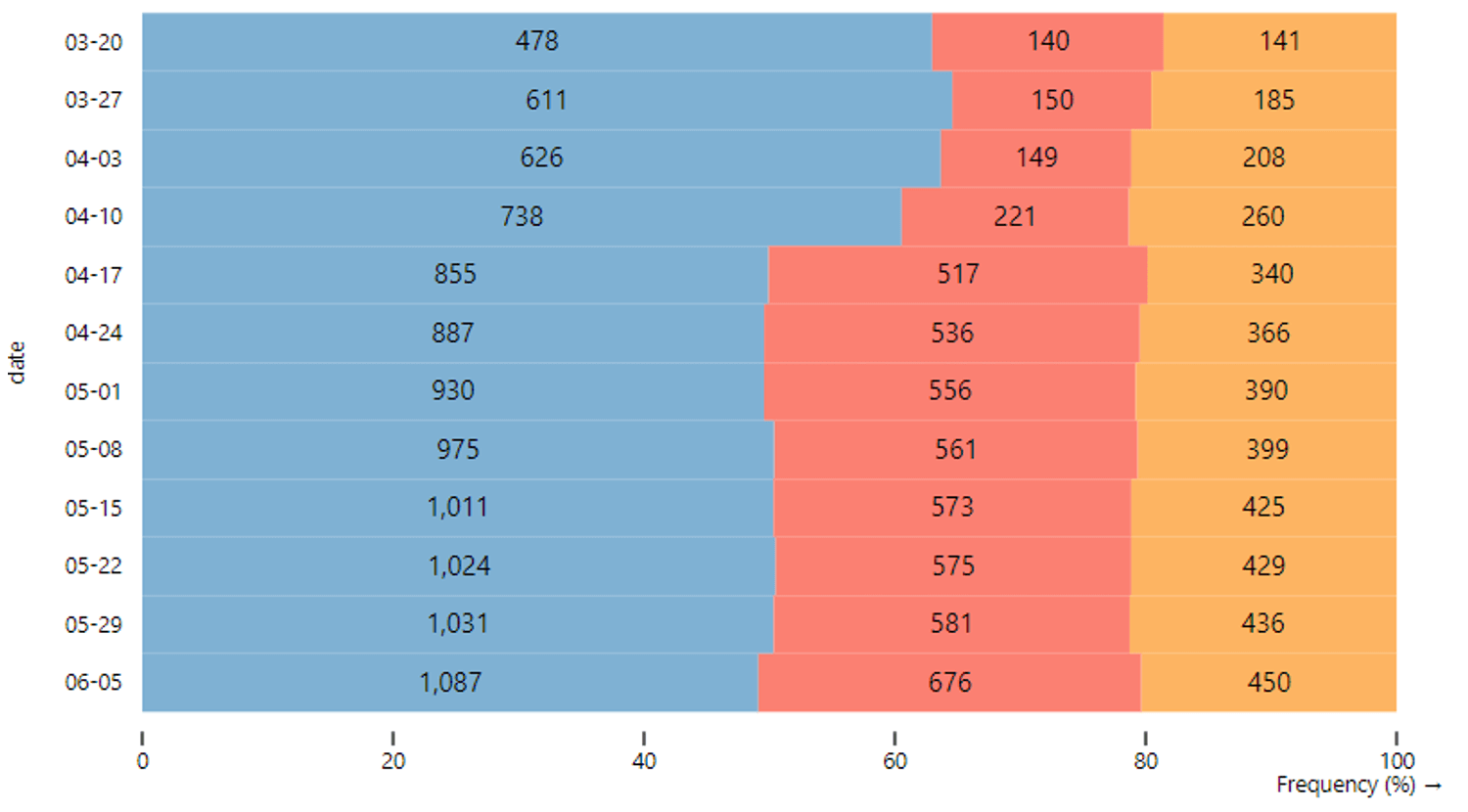

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, more than half (49.1%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.5% are still remaining in the country. The slight change in shares over the last week is due to the addition of +122 companies to the KSE Institute database as a result of synchronization with the project https://squeezingputin.com.

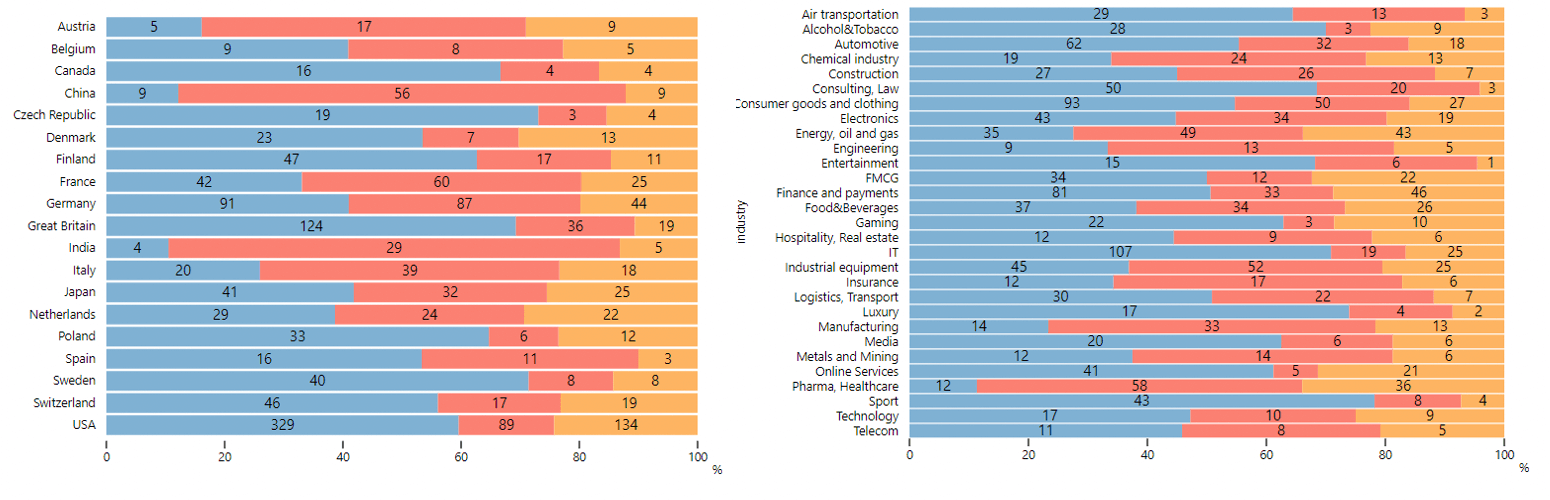

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs below.

Decisions of Western companies by country and sector:

How the capitalization of the largest public companies changed during the war

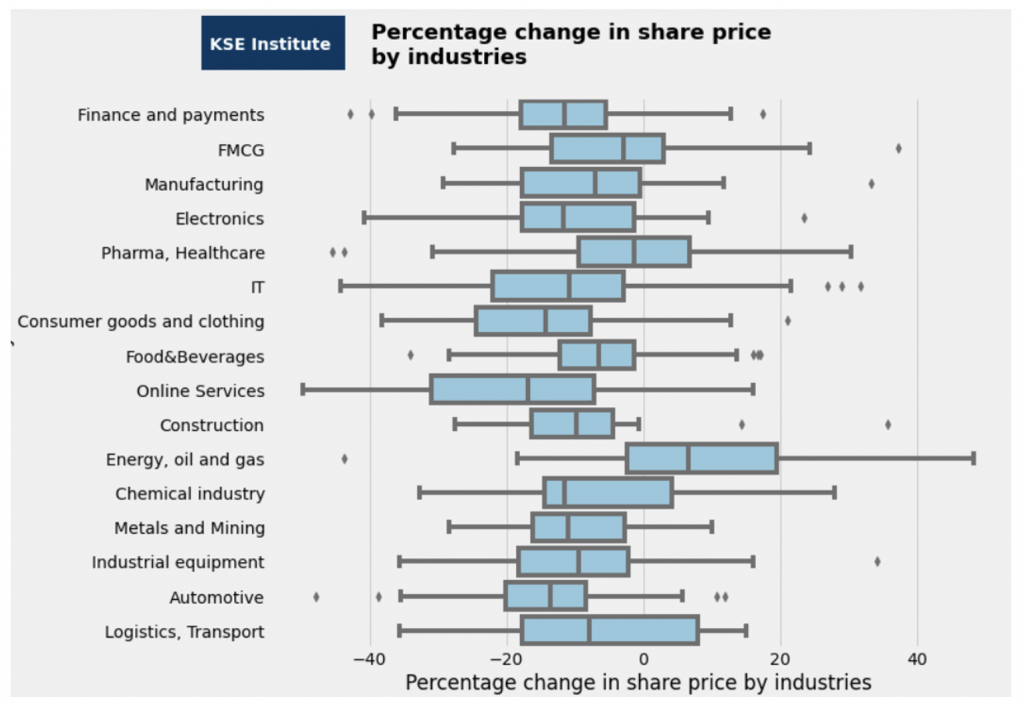

The only industry that has shown steady growth is Energy, Oil and Gas.

WEEKLY FOCUS. GAS PAYMENTS IN RUBLES

Among European buyers of gas, 9 refused to pay in rubles. Still, the largest buyers started to pay under the new scheme. Payment arrangements are not completely public and it is unclear whether companies are opening ruble accounts and breaking sanctions or not.

On March 31st 2022 Russia issued a new “Executive Order On the Special Procedure to Allow Foreign Buyers to Meet their Commitments to Russian Natural Gas Suppliers”. According to the order, companies have to pay for natural gas supplied in rubles. Russia demanded companies to open accounts in euros or dollars and in rubles in Gazprombank. First, companies pay in euros, then exchange euros for rubles and put it in a ruble account and then pay. European countries split in their decisions. It took more than a month for the EU commission to clarify whether the new scheme complies with the sanctions but it still did not bring 100% clarity. It said that companies can open euro or dollar accounts but accounts in rubles will be breaking sanctions.

Some of the companies refused to pay under the new scheme and they faced harsh consequences. Among them are⁶:

- • PGNiG (Poland): supplies cut April 27

- • Bulgargaz (Bulgaria): supplies cut April 27

- • Gasum (Finland): supplies cut May 21

- • GasTerra (Netherlands): supplies cut May 31⁷

- • Shell Energy (Germany): supplies cut May 31⁸

- • Lithuania (Amber Grid), Estonia (Eesti gas), Lanvia (JSC Conexus Baltic Grid ) stopped buying gas from Russia and prepared two months of storage.⁹

Still, many companies continued to pay to Gazprom, opening euro or dollar accounts in Gazprombank. It is not clear whether they used rubble accounts for payment. Companies that pay under the new scheme include:

- • MVM (Hungary)

- • VNG, RWE, Uniper (Germany)

- • Engie (France)

- • Eni (Italy)

- • OMV (Austria)

- • CEZ (Czech republic)

- • SPP (Slovakia)

- • Geoplin (Slovakia)

- • DEPA Commerce, Mytilineos and Prometheus Gas¹⁰ (Greece)

- • UK allowed deals with Gasprombank till May 31st¹¹

Overally, 9 EU companies refused to pay in rubles, including ones from Netherlands, Poland, Bulgaria, Danmark, Finland, Baltic states. Still, the largest buyers (specifically in Italy and Germany – only one company from Germany refused to pay in rubles, see the chart on the right) started to pay under the new scheme. Payment arrangements are not completely known to the public and it is unclear whether companies are opening ruble accounts, which the EU Commission commented would mean breaking of sanction.